Despite wild HYPE volatility during the month of January, hwHYPE continued to deliver steady and competitive yields.

The 30-day APR of the vault is currently 5.2%, and the 7-day APR 13%. This makes it the highest performing HYPE yield opportunity on the market at present.

Hyperwave hwHYPE: ~5.3%

Hyperbeat Ultra HYPE: ~4.1%

Harmonix haHYPE: ~3.9%

Looping Collective lHYPE: ~3.8%

Hyperdrive HYPED: ~2.3%

Data from Dimensional Capital

Allocations

hwHYPE allocation has remained stable through early 2026, with lending continuing to anchor the portfolio while tactical positions in fixed income and LSTs provide diversification and enhanced risk-adjusted returns.

Lending remains the dominant allocation, primarily via Hypurrfi

Fixed income exposure via Pendle stHYPE PT plays a stabilizing role, contributing predictable returns and dampening volatility.

Strategic exposure to liquid staking derivatives and vault deposits supports compounding and optional upside without materially increasing risk.

Other categories — including withdrawal queues, holds, debt positions, and DEX-related activity make up a smaller portion of the remaining allocation mix.

Operations

Manager activity spiked significantly in late December 2025, but has since normalized in early 2026 around routine portfolio management and yield optimization.

Arbitrage Performance

Sporadic arbitrage continues between beHYPE (@hyperbeat) and kHYPE (kinetiqxyz)

Post-December, the number of arbs has declined and stabilized at a lower baseline, indicating more efficient markets.

Performance Summary

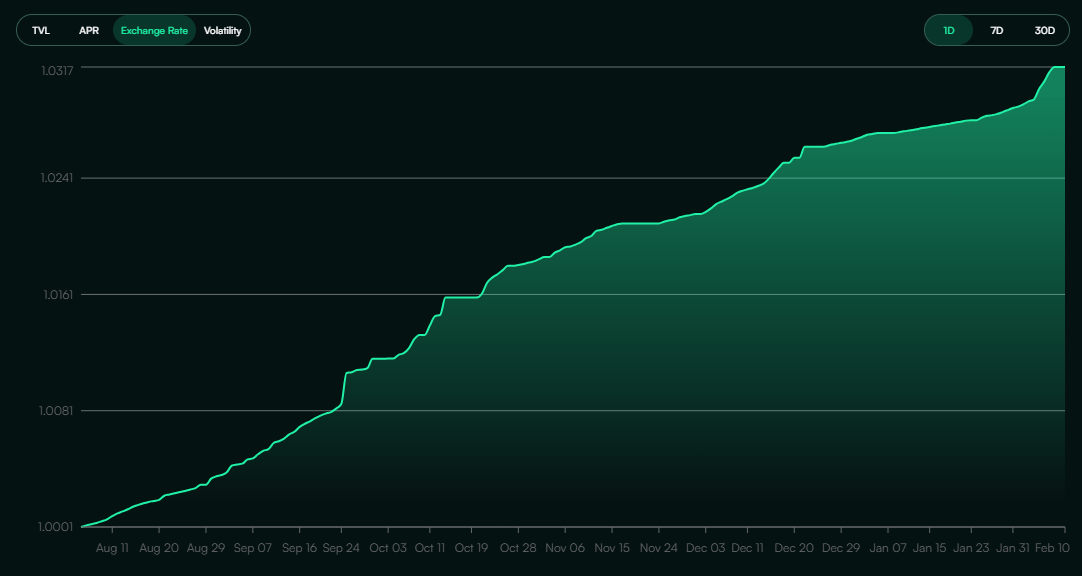

Overall, In the six months since the vault went live, the hwHYPE exchange rate has steadily increased from ~1.0001 (Aug 2025) to ~1.0317 (Feb 2026). This corresponds to an approximate +3.2% absolute gain, or ~6.5% annualized, reflecting consistent compounding with minimal volatility.

Subscribe or follow @Hyperwavefi on X for more hwHYPE updates!

References: