Total APR for $hwHYPE over the last month is 4.7%.

The vault outperformed peers with strong, consistent performance through diversified strategies, disciplined rebalancing and arbitrage execution amid fluctuating market conditions.

Performance

Dimensional data shows $hwHYPE with a 4.7% 30-day APR, significantly ahead of peers. The yield trajectory is steady and upward, showing minimal volatility and smooth, consistent yield generation.

hwHYPE: 4.7% APR

Harmonix haHYPE: 3.2%

HYPE staking: 2.26%

This outperformance was driven by higher utilization on lending markets and opportunistic arbitrage vs. AMM liquidity.

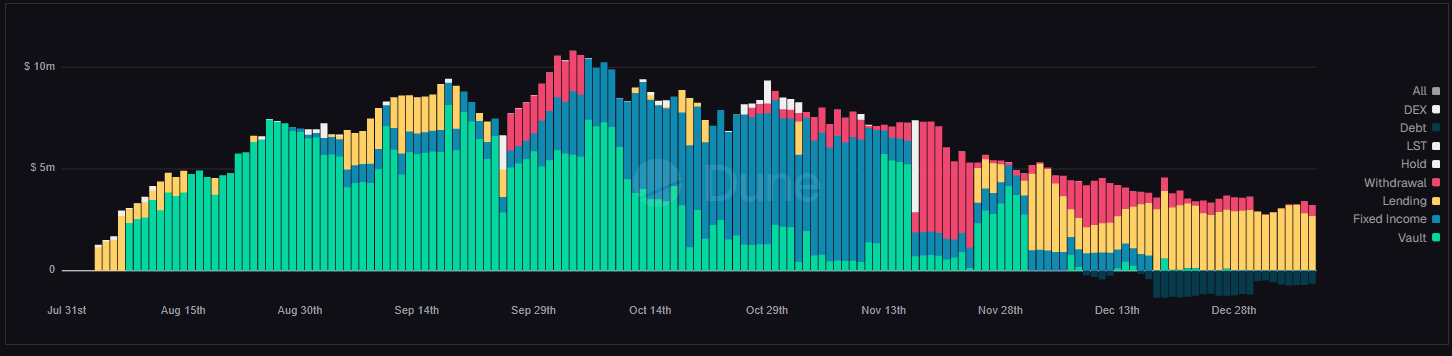

Allocations

The current allocation shows the vault's holdings are predominantly in lending positions.

Approximately 80% in @hyperlendx kHYPE (@kinetiq_xyz) at $3.22M, with smaller slices for @HypurrFi wHYPE (@HypurrFi) ($57k) and fixed income via @pendle_fi stHYPE (@ValantisLabs). Debt is fully concentrated in Hyperlend wHYPE at -$787k, reflecting leveraged exposure.

Shoutout to all our partner protocols for enabling us to earn that sweet yield!

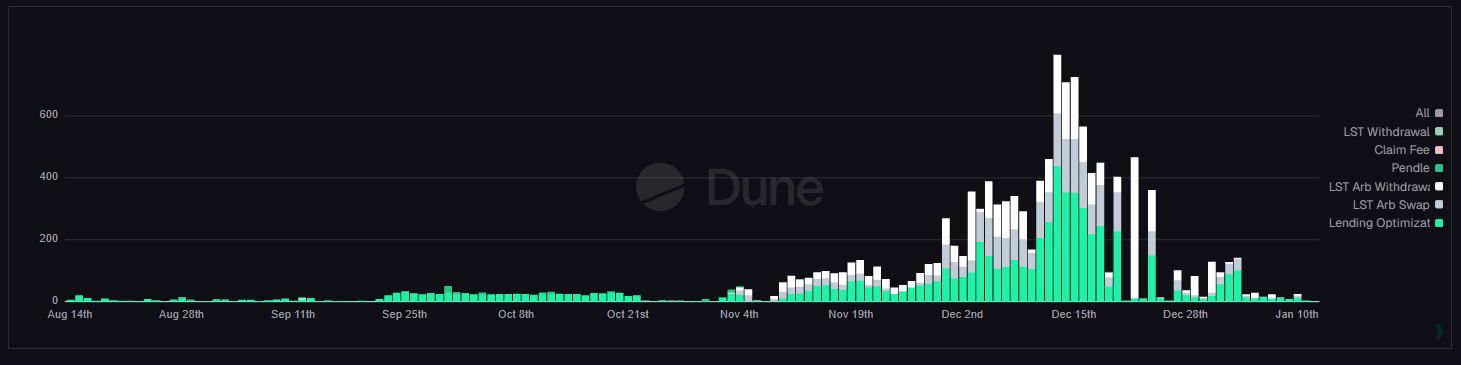

Vault operations

The Manager Actions chart shows a sharp rise in operational actions beginning in mid-November, representing heightened lending optimization, withdrawals, and arbitrage activity.

Arbitrage

Arbing provides tactical upside to boost the steady returns from lending and fixed yield.

Arbitrage spiked during high-opportunity periods, such as mid-November and early December 2025, when the vault actively capitalized on rate discrepancies in response to market conditions.

Most of the traded volume was concentrated in $kHYPE, with smaller but consistent participation in $beHYPE.

Arbitrage: Making Small Inefficiencies Great Again.

Summary

Up and to the right*

As shown in the exchange rate, the vault has sustained unwavering growth since its inception in August 2025, with the exchange rate ascending from approximately 1.0001 on August 11 to 1.0272 on January 7, 2026. This represents a total growth of about 2.72% over roughly 150 days, equating to an annualized APY of approximately 6.75% based on compounding.

In summary...

hwHYPE has continued to deliver consistent returns through disciplined execution and risk-managed exposure.

Yield generation has remained stable despite changing market conditions, supported primarily by lending and opportunistic arbitrage.

Portfolio allocation has been carefully balanced to prioritize smooth and sustainable yields.

Execution across strategies has remained efficient, contributing to steady compounding over the period.

Follow @Hyperwavefi on X for more monthly $hwHYPE vault updates!

Hyperliquid.

*Past performance doesn’t guarantee future results… (but it does look pretty good, doesn’t it?)

References: